Old vs New GST Rates — What Changed in 2025 (56th GST Council Update)

Introduction

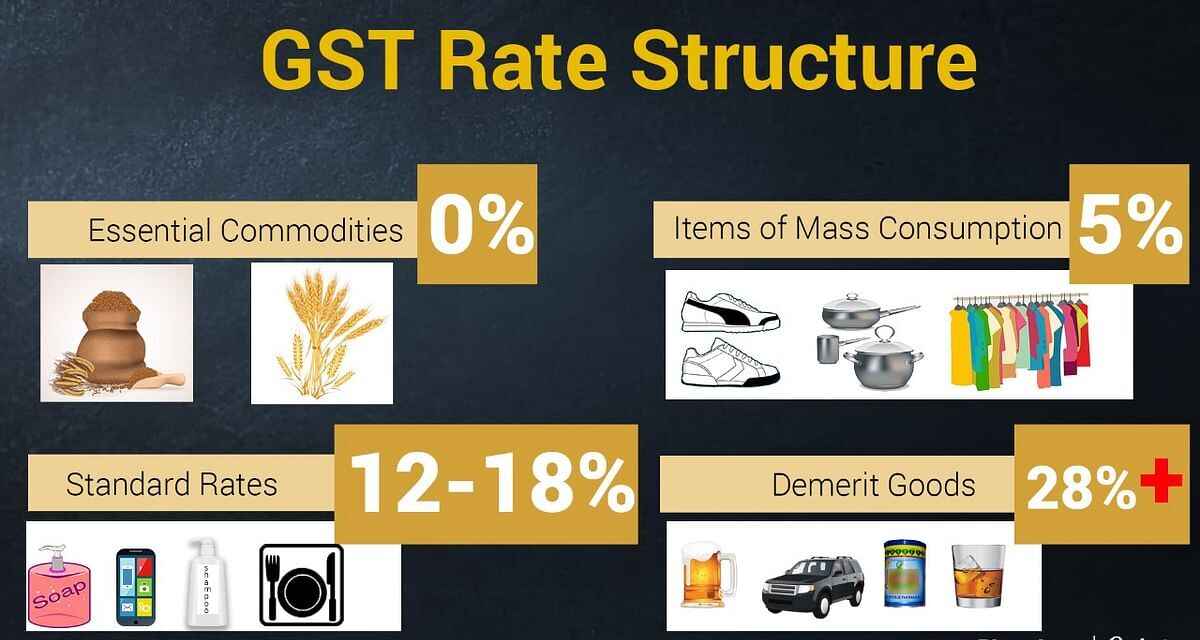

In September 2025, the 56th GST Council meeting brought in sweeping changes to India’s GST rate structure. Several tax slabs have been rationalized, merged, or simplified to ease compliance and reduce confusion. In this blog, we compare the old vs new GST rates and explain how the changes impact businesses and consumers.

Why the Change?

The existing GST regime had many tax slabs, making classification and compliance cumbersome.

The objective is to simplify the system and reduce ambiguity in rate selection.

Rationalization aims to make it easier for businesses to map their goods & services to correct HSN/SAC codes and corresponding tax rates.

Key Highlights of the Revision

Fewer slabs Some of the older slabs got merged or removed, leading to a leaner set of GST rates.

Effective Date The new rates are applicable from 22nd September 2025 onward.

HSN / SAC classification matters more

Each product (goods) or service must be mapped to its correct HSN or SAC code, which now directly determines which revised rate applies.

Side-by-Side: Old Rate vs New Rate

A detailed table shows, for each HSN / SAC code description, what the old GST rate was and what the new rate is starting 22nd Sept 2025.

— For example:

Some goods that were earlier taxed at 18% may now be taxed at a lower or higher slab.

Services might see shifts between 12%, 18%, etc., depending on their classification.

(To include in your blog, you may want to embed or convert the rate table to your own styling.)

What Businesses Should Do Next

Re-classify inventory / services

Review all goods and services your business deals with, and map them to correct HSN / SAC codes under the new regime.

Update systems & software

Accounting or ERP systems must be updated so that tax rates auto-apply correctly. Yalu.in can help businesses integrate these changes smoothly.

Train staff / educate stakeholders

Your billing team, accountants, and even customers may need awareness of which items now attract which rates.

Comply from the effective date

Ensure that invoices generated from 22nd September 2025 use the revised rates. Transactions before that date follow the old regime.

Audit / verify transitional cases

Some transactions might straddle the date or be ongoing contracts. Pay care to whether old rates or new ones apply, and document justifications.

How Yalu.in Helps With GST Compliance

Yalu.in offers features that make the transition smoother:

Auto-population of GST: Once you tag contacts and items with their GSTIN and HSN/SAC, Yalu.in auto-selects the correct tax components.

Item classification: You can label items properly as “Goods” or “Services” with associated HSN/SAC.

E-invoicing support: For applicable B2B transactions, invoices can be authenticated electronically via the GSTN, enhancing security and transparency.

One-click filing & validation: Generate GSTR returns (such as GSTR-1, GSTR-3B, GSTR-9) and file them via linkage with the GST portal. Approval workflows help reduce filing errors.

Impact on Businesses & Consumers

Reduced ambiguity: Fewer slabs reduce disputes over classification.

Potential cost & pricing changes: Some goods or services may become cheaper (if they move to a lower slab) or costlier (if moved up).

Simplified audit and compliance: With clearer slab structure, audits, returns, and reconciliations become cleaner.

Need for careful transition: Businesses must diligently track dates, especially for ongoing contracts or backlogged sales.

Conclusion

The 2025 GST rate revision is a major reform intended to simplify taxation and reduce misclassification. However, its success depends on how well businesses adapt—by reclassifying items correctly, updating software, training staff, and ensuring compliance right from day one.

With Yalu.in, businesses can stay GST-ready by using automated tools, accurate classifications, and seamless filing integrations.

👉 Do you want me to also create a GST comparison table (Old vs New Rates) in a clean blog format for Yalu.in so you can directly publish it?